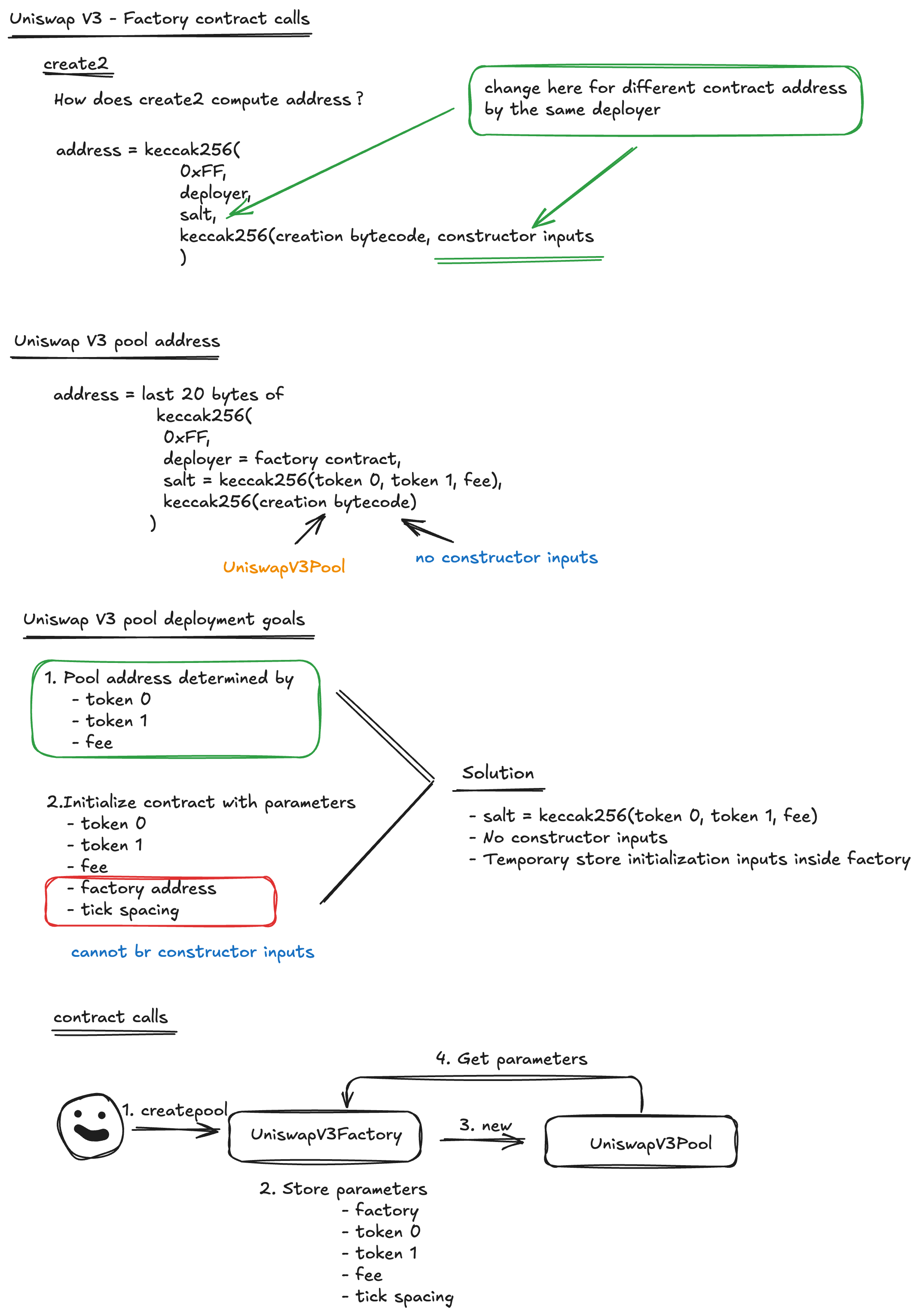

一、factory

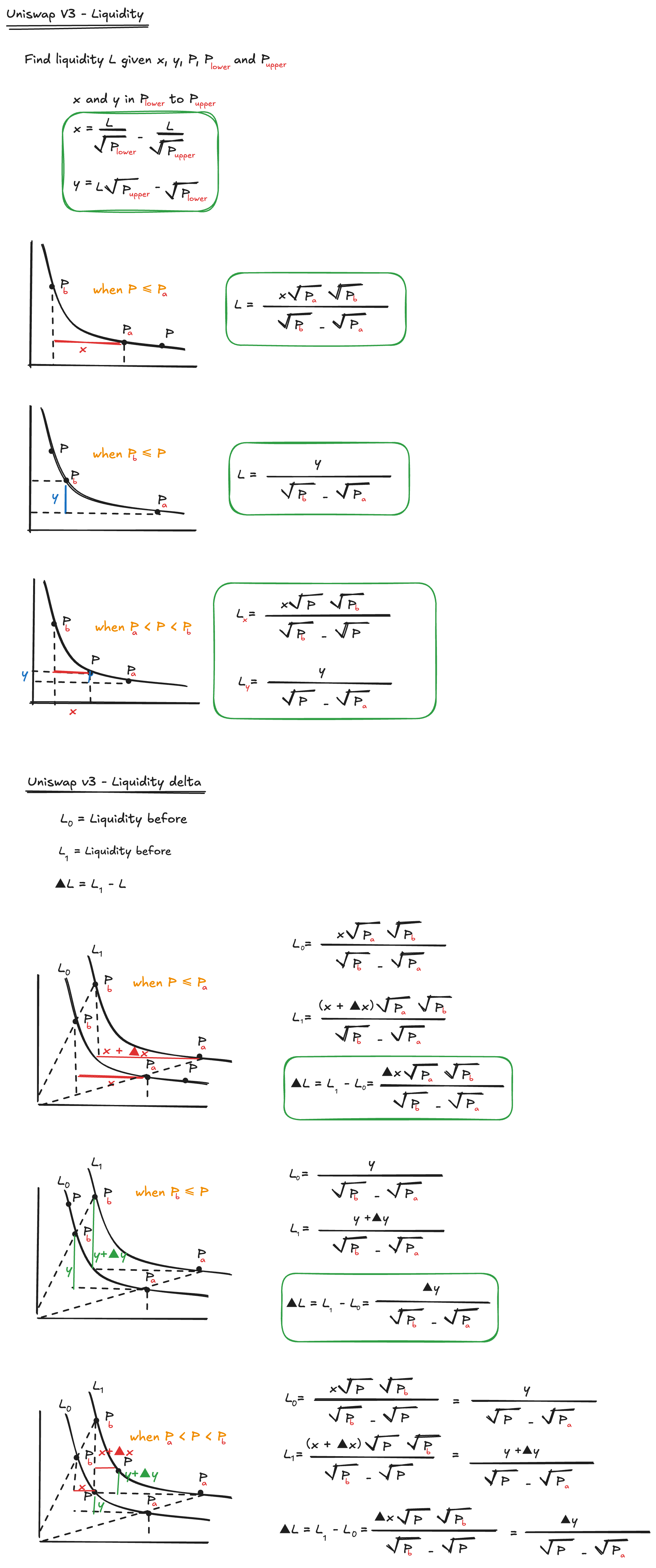

二、Liquidity

Pool

mint

用户调用NonfungiblePositionManager 的 mint 来调用 Pool 的 mint,获取到如果要增加 amount数量的流动性到 pool需要添加多少的 token0 和 token1

function mint(

address recipient,

int24 tickLower,

int24 tickUpper,

uint128 amount,

bytes calldata data

) external override lock returns (uint256 amount0, uint256 amount1) {

require(amount > 0);

(, int256 amount0Int, int256 amount1Int) =

_modifyPosition(

ModifyPositionParams({

owner: recipient,

tickLower: tickLower,

tickUpper: tickUpper,

liquidityDelta: int256(amount).toInt128()

})

);

amount0 = uint256(amount0Int);

amount1 = uint256(amount1Int);

uint256 balance0Before;

uint256 balance1Before;

if (amount0 > 0) balance0Before = balance0();

if (amount1 > 0) balance1Before = balance1();

IUniswapV3MintCallback(msg.sender).uniswapV3MintCallback(amount0, amount1, data);

if (amount0 > 0) require(balance0Before.add(amount0) <= balance0(), 'M0');

if (amount1 > 0) require(balance1Before.add(amount1) <= balance1(), 'M1');

emit Mint(msg.sender, recipient, tickLower, tickUpper, amount, amount0, amount1);

}调用 _modifyPosition

- 根据当前价格和提供的区间,算出需要的 token0 / token1 数量。

- 更新 position 信息。

IUniswapV3MintCallback(msg.sender).uniswapV3MintCallback(amount0, amount1, data)

- 回调给调用方(通常是 Manager),让它把 token0/1 转进池子。

- 回调设计是 Uniswap 的一大特点,保证池子不用持有别人的授权。

校验资金到位。

触发 Mint 事件。

function _modifyPosition(ModifyPositionParams memory params)

private

noDelegateCall

returns (

Position.Info storage position,

int256 amount0,

int256 amount1

)

{

checkTicks(params.tickLower, params.tickUpper);

Slot0 memory _slot0 = slot0; // SLOAD for gas optimization

position = _updatePosition(

params.owner,

params.tickLower,

params.tickUpper,

params.liquidityDelta,

_slot0.tick

);

if (params.liquidityDelta != 0) {

if (_slot0.tick < params.tickLower) {

// current tick is below the passed range; liquidity can only become in range by crossing from left to

// right, when we'll need _more_ token0 (it's becoming more valuable) so user must provide it

amount0 = SqrtPriceMath.getAmount0Delta(

TickMath.getSqrtRatioAtTick(params.tickLower),

TickMath.getSqrtRatioAtTick(params.tickUpper),

params.liquidityDelta

);

} else if (_slot0.tick < params.tickUpper) {

// current tick is inside the passed range

uint128 liquidityBefore = liquidity; // SLOAD for gas optimization

// write an oracle entry

(slot0.observationIndex, slot0.observationCardinality) = observations.write(

_slot0.observationIndex,

_blockTimestamp(),

_slot0.tick,

liquidityBefore,

_slot0.observationCardinality,

_slot0.observationCardinalityNext

);

amount0 = SqrtPriceMath.getAmount0Delta(

_slot0.sqrtPriceX96,

TickMath.getSqrtRatioAtTick(params.tickUpper),

params.liquidityDelta

);

amount1 = SqrtPriceMath.getAmount1Delta(

TickMath.getSqrtRatioAtTick(params.tickLower),

_slot0.sqrtPriceX96,

params.liquidityDelta

);

liquidity = LiquidityMath.addDelta(liquidityBefore, params.liquidityDelta);

} else {

// current tick is above the passed range; liquidity can only become in range by crossing from right to

// left, when we'll need _more_ token1 (it's becoming more valuable) so user must provide it

amount1 = SqrtPriceMath.getAmount1Delta(

TickMath.getSqrtRatioAtTick(params.tickLower),

TickMath.getSqrtRatioAtTick(params.tickUpper),

params.liquidityDelta

);

}

}

}核心逻辑:根据当前价格 slot0.tick 和 [tickLower, tickUpper] 的关系,决定需要多少 token0 和 token1。

如果 当前价格 < tickLower

→ 价格在区间左边

→ LP 的流动性还没生效(要等价格涨到区间才会生效)。

→ 用户只需要提供 token0。

如果 tickLower <= 当前价格 < tickUpper

→ 价格在区间内

→ 流动性马上生效。

→ 用户需要同时提供 token0 + token1。

如果 当前价格 >= tickUpper

→ 价格在区间右边

→ 流动性还没生效(要等价格跌到区间才会生效)。

→ 用户只需要提供 token1。

🔹 _updatePosition的主要流程

当用户调用 mint()(增加流动性)或者 burn()(减少流动性)时,都会进入 _updatePosition,它要做的事可以总结为三步:

1.取出当前 position 信息

position = positions.get(owner, tickLower, tickUpper);每个 LP 的区间 [tickLower, tickUpper] 有独立的 position,记录了流动性和手续费信息。

2.更新边界 tick(tickLower 和 tickUpper)

flippedLower = ticks.update(..., false, ...);

flippedUpper = ticks.update(..., true, ...);- tick.update 会调整每个 tick 的流动性(gross 和 net),并判断这个 tick 是否被“翻转”了(从无流动性变成有流动性,或者相反)。

- 如果翻转了,tickBitmap 会 flip,表示这个 tick 现在是“活跃的边界”,swap 的时候可能会跨到它。

3.更新 position 里存储的 feeGrowth 累计值

(feeGrowthInside0X128, feeGrowthInside1X128) =

ticks.getFeeGrowthInside(...);

position.update(liquidityDelta, feeGrowthInside0X128, feeGrowthInside1X128);- 这一步是为了让 LP 将来能精确领取手续费(因为手续费是按“进入 position 的时刻”的增长率开始算的)。

🔹 ticks.update 内部逻辑

tick 本质上就是“流动性的边界点”,每个 tick 记录了 跨过它时要加/减多少流动性。

uint128 liquidityGrossBefore = info.liquidityGross;

uint128 liquidityGrossAfter = LiquidityMath.addDelta(liquidityGrossBefore, liquidityDelta);- liquidityGross:这个 tick 上总共有多少流动性挂靠。

- liquidityNet:当价格跨过这个 tick时,池子总流动性要加还是减。

再结合 upper 参数:

- 如果是 下边界(lower tick):进入区间时要加 liquidity,出去时要减。

如果是 上边界(upper tick):进入区间时要减 liquidity,出去时要加。

所以 liquidityNet 更新时符号是反的:

info.liquidityNet = upper

? int256(info.liquidityNet).sub(liquidityDelta).toInt128()

: int256(info.liquidityNet).add(liquidityDelta).toInt128();burn

function burn(

int24 tickLower,

int24 tickUpper,

uint128 amount

) external override lock returns (uint256 amount0, uint256 amount1) {

(Position.Info storage position, int256 amount0Int, int256 amount1Int) =

_modifyPosition(

ModifyPositionParams({

owner: msg.sender,

tickLower: tickLower,

tickUpper: tickUpper,

liquidityDelta: -int256(amount).toInt128()

})

);

amount0 = uint256(-amount0Int);

amount1 = uint256(-amount1Int);

if (amount0 > 0 || amount1 > 0) {

(position.tokensOwed0, position.tokensOwed1) = (

position.tokensOwed0 + uint128(amount0),

position.tokensOwed1 + uint128(amount1)

);

}

emit Burn(msg.sender, tickLower, tickUpper, amount, amount0, amount1);

}- 作用:用户调用 NonfungiblePositionManager 的 burn 来调用 Pool 的 burn 从一个指定的 price range [tickLower, tickUpper] 中移除流动性。

输入参数:

- tickLower:这个 position 的下边界 tick

- tickUpper:这个 position 的上边界 tick

- amount:要移除多少流动性 (liquidity)

返回值:

- amount0:用户从这次 burn 对应的 position 上应得的 token0 数量

- amount1:用户从这次 burn 对应的 position 上应得的 token1 数量

⚠️ 注意:调用 burn 后,用户 并不会立刻拿到 token0 / token1,而是把它们记录到 position 的 tokensOwed0 / tokensOwed1 中。用户要再调用 collect() 才能真正提走代币。

核心逻辑

- 调用

_modifyPosition

(Position.Info storage position, int256 amount0Int, int256 amount1Int) =

_modifyPosition(

ModifyPositionParams({

owner: msg.sender,

tickLower: tickLower,

tickUpper: tickUpper,

liquidityDelta: -int256(amount).toInt128()

})

);- _modifyPosition 是内部函数,负责更新 position 的状态。

- liquidityDelta 设置为 负数,表示减少流动性。

它会返回:

- position:用户在这个区间内的 position 结构体

- amount0Int:对应减少这部分流动性时,position 内减少的 token0 数量(可能是负数)

- amount1Int:对应减少这部分流动性时,position 内减少的 token1 数量

- 取正数作为返回值

amount0 = uint256(-amount0Int);

amount1 = uint256(-amount1Int);- 这里 amount0Int、amount1Int 可能是负数,所以取反再转成正数。

- amount0 / amount1 = 本次 burn 这部分流动性应释放出来的 token0、token1 数量。

- 累加到 position 的应收款项

if (amount0 > 0 || amount1 > 0) {

(position.tokensOwed0, position.tokensOwed1) = (

position.tokensOwed0 + uint128(amount0),

position.tokensOwed1 + uint128(amount1)

);

}- 用户移除了流动性,但 Uniswap 不会马上转钱给你,而是把应得的 token0/token1 加到 tokensOwed0/tokensOwed1。

- 等你再调用 collect() 时,这些累计的 owed token 会真正打给你。

实际打钱时用的函数collect

function collect( address recipient, int24 tickLower, int24 tickUpper, uint128 amount0Requested, uint128 amount1Requested ) external override lock returns (uint128 amount0, uint128 amount1) { // we don't need to checkTicks here, because invalid positions will never have non-zero tokensOwed{0,1} Position.Info storage position = positions.get(msg.sender, tickLower, tickUpper); amount0 = amount0Requested > position.tokensOwed0 ? position.tokensOwed0 : amount0Requested; amount1 = amount1Requested > position.tokensOwed1 ? position.tokensOwed1 : amount1Requested; if (amount0 > 0) { position.tokensOwed0 -= amount0; TransferHelper.safeTransfer(token0, recipient, amount0); } if (amount1 > 0) { position.tokensOwed1 -= amount1; TransferHelper.safeTransfer(token1, recipient, amount1); } emit Collect(msg.sender, recipient, tickLower, tickUpper, amount0, amount1); }fork 主网测试增删流动性接口

// SPDX-License-Identifier: MIT

pragma solidity 0.8.24;

import {Test, console2} from "forge-std/Test.sol";

import {IERC20} from "../src/interfaces/IERC20.sol";

import {IWETH} from "../src/interfaces/IWETH.sol";

import {INonfungiblePositionManager} from "../src/interfaces/uniswap-v3/INonfungiblePositionManager.sol";

import {UNISWAP_V3_NONFUNGIBLE_POSITION_MANAGER, DAI, WETH} from "../src/Constants.sol";

struct Position {

uint96 nonce;

address operator;

address token0;

address token1;

uint24 fee;

int24 tickLower;

int24 tickUpper;

uint128 liquidity;

uint256 feeGrowthInside0LastX128;

uint256 feeGrowthInside1LastX128;

uint128 tokensOwed0;

uint128 tokensOwed1;

}

contract UniswapV3LiquidityTest is Test {

IWETH private constant weth = IWETH(WETH);

IERC20 private constant dai = IERC20(DAI);

INonfungiblePositionManager private constant manager =

INonfungiblePositionManager(UNISWAP_V3_NONFUNGIBLE_POSITION_MANAGER);

// 0.3%

int24 private constant MIN_TICK = -887272;

int24 private constant MAX_TICK = 887272;

// DAI/WETH 3000

uint24 private constant POOL_FEE = 3000;

int24 private constant TICK_SPACING = 60;

function setUp() public {

deal(DAI, address(this), 3000 * 1e18);

deal(WETH, address(this), 3 * 1e18);

weth.approve(address(manager), type(uint256).max);

dai.approve(address(manager), type(uint256).max);

}

function mint() private returns (uint256 tokenId) {

(tokenId,,,) = manager.mint(

INonfungiblePositionManager.MintParams({

token0: DAI,

token1: WETH,

fee: POOL_FEE,

tickLower: MIN_TICK / TICK_SPACING * TICK_SPACING,

tickUpper: MAX_TICK / TICK_SPACING * TICK_SPACING,

amount0Desired: 1000 * 1e18,

amount1Desired: 1e18,

amount0Min: 0,

amount1Min: 0,

recipient: address(this),

deadline: block.timestamp

})

);

}

function getPosition(uint256 tokenId) private view returns (Position memory) {

(

uint96 nonce,

address operator,

address token0,

address token1,

uint24 fee,

int24 tickLower,

int24 tickUpper,

uint128 liquidity,

uint256 feeGrowthInside0LastX128,

uint256 feeGrowthInside1LastX128,

uint128 tokensOwed0,

uint128 tokensOwed1

) = manager.positions(tokenId);

Position memory position = Position({

nonce: nonce,

operator: operator,

token0: token0,

token1: token1,

fee: fee,

tickLower: tickLower,

tickUpper: tickUpper,

liquidity: liquidity,

feeGrowthInside0LastX128: feeGrowthInside0LastX128,

feeGrowthInside1LastX128: feeGrowthInside1LastX128,

tokensOwed0: tokensOwed0,

tokensOwed1: tokensOwed1

});

return position;

}

// Mint a new position by adding liquidity to DAI/WETH pool with 0.3% fee.

// - You are free to choose the price range

// - Ticks must be divisible by tick spacing of the pool

// - This test contract is given 3000 DAI and 3 WETH. Put any amount of tokens

// not exceeding this contracts's balance.

// - Set recipient of NFT (that represents the ownership of this position) to this contract.

function test_mint() public {

(uint256 tokenId,, uint256 amount0, uint256 amount1) = manager.mint(

INonfungiblePositionManager.MintParams({

token0: DAI,

token1: WETH,

fee: POOL_FEE,

tickLower: MIN_TICK / TICK_SPACING * TICK_SPACING,

tickUpper: MAX_TICK / TICK_SPACING * TICK_SPACING,

amount0Desired: 1000 * 1e18,

amount1Desired: 1e18,

amount0Min: 0,

amount1Min: 0,

recipient: address(this),

deadline: block.timestamp

})

);

console2.log("Amount 0 added %e", amount0);

console2.log("Amount 1 added %e", amount1);

assertEq(manager.ownerOf(tokenId), address(this));

Position memory position = getPosition(tokenId);

assertEq(position.token0, DAI);

assertEq(position.token1, WETH);

assertGt(position.liquidity, 0);

}

// Increase liquidity for the position with token id = `tokenId`.

// 3000 DAI and 3 WETH were initially given to this contract.

// Some of the tokens where used to mint a new position.

// Use any token amount less than or equal to contract's balance.

function test_increaseLiquidity() public {

uint256 tokenId = mint();

Position memory p0 = getPosition(tokenId);

(uint256 liquidityDelta, uint256 amount0, uint256 amount1) = manager.increaseLiquidity(

INonfungiblePositionManager.IncreaseLiquidityParams({

tokenId: tokenId,

amount0Desired: 1000 * 1e18,

amount1Desired: 1e18,

amount0Min: 0,

amount1Min: 0,

deadline: block.timestamp

})

);

console2.log("Amount 0 added %e", amount0);

console2.log("Amount 1 added %e", amount1);

Position memory p1 = getPosition(tokenId);

assertGt(p1.liquidity, p0.liquidity);

assertGt(liquidityDelta, 0);

}

// Decrease liquidity for the position with token id = `tokenId`.

// - Amount of liquidity to decrease cannot exceed the position's liquidity.

function test_decreaseLiquidity() public {

uint256 tokenId = mint();

Position memory p0 = getPosition(tokenId);

(uint256 amount0, uint256 amount1) = manager.decreaseLiquidity(

INonfungiblePositionManager.DecreaseLiquidityParams({

tokenId: tokenId,

liquidity: p0.liquidity,

amount0Min: 0,

amount1Min: 0,

deadline: block.timestamp

})

);

console2.log("Amount 0 decreased %e", amount0);

console2.log("Amount 1 decreased %e", amount1);

Position memory p1 = getPosition(tokenId);

assertEq(p1.liquidity, 0);

assertGt(p1.tokensOwed0, 0);

assertGt(p1.tokensOwed1, 0);

}

// Remove all liquidity (including fees) from a position by calling collect()

// - Decrease all liquidity for the position with token id = `tokenId`

// - Transfer tokens from NonFungiblePositionManager to this contract

// by calling collect()

function test_collect() public {

uint256 tokenId = mint();

Position memory p0 = getPosition(tokenId);

manager.decreaseLiquidity(

INonfungiblePositionManager.DecreaseLiquidityParams({

tokenId: tokenId,

liquidity: p0.liquidity,

amount0Min: 0,

amount1Min: 0,

deadline: block.timestamp

})

);

(uint256 amount0, uint256 amount1) = manager.collect(

INonfungiblePositionManager.CollectParams({

tokenId: tokenId,

recipient: address(this),

amount0Max: type(uint128).max,

amount1Max: type(uint128).max

})

);

console2.log("--- collect ---");

console2.log("Amount 0 collected %e", amount0);

console2.log("Amount 1 collected %e", amount1);

Position memory p1 = getPosition(tokenId);

assertEq(p1.liquidity, 0);

assertEq(p1.tokensOwed0, 0);

assertEq(p1.tokensOwed1, 0);

}

}

评论 (0)